Buying dog insurance seems simple-just pick a plan, pay monthly, and let the insurer cover the bills when your pup gets sick. But too many dog owners make the same mistakes that leave them paying out of pocket when they least expect it. I’ve seen it happen again and again in Portland, where emergency vet visits are common and costs keep climbing. One client paid $400 a month for a plan that didn’t cover cruciate ligament surgery-exactly what her 3-year-old Labrador needed. She was shocked. She thought she was covered. She wasn’t.

Not Reading the Exclusions

Every dog insurance policy has exclusions. These aren’t hidden in fine print-they’re clearly listed. But most people skip them. Common exclusions include pre-existing conditions, hereditary issues like hip dysplasia in German Shepherds, and even routine care like vaccines or flea treatments. Some policies exclude certain breeds entirely, especially if they’re considered high-risk. A recent survey of 1,200 dog owners found that 68% didn’t know their policy excluded dental disease, which affects over 80% of dogs by age three.

If your dog had a limp last year, even if it resolved on its own, many insurers will call it pre-existing and deny future claims for any leg-related issues. Always ask: “What conditions are not covered?” and get the answer in writing.

Choosing the Lowest Premium Without Checking the Details

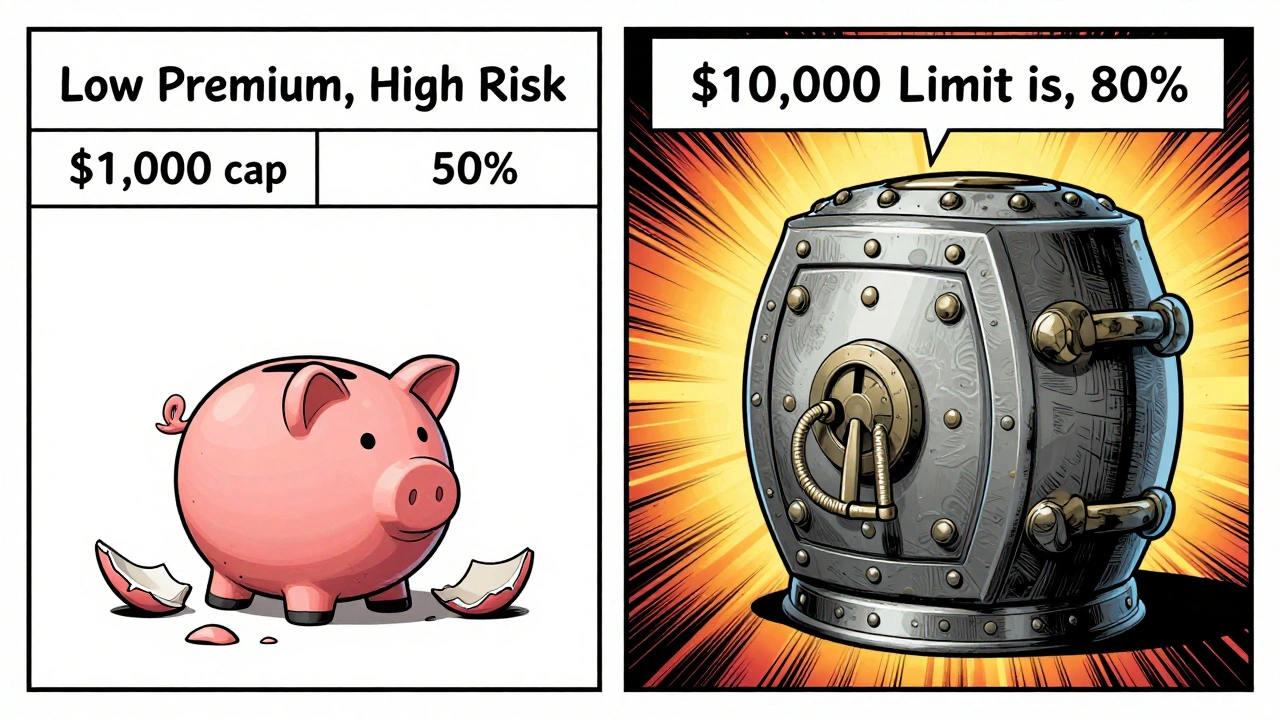

A $20 monthly premium looks great. But what are you really getting? Some low-cost plans cap payouts per condition at $1,000. A torn ACL can cost $3,000 to $5,000 to fix. If your plan only covers $1,000, you’re left with $2,000-$4,000 in out-of-pocket costs. That’s not insurance-that’s a discount coupon.

Look at the annual payout limit. Good plans offer $10,000 or more per year. Also check the reimbursement rate. Some companies pay 70%, others only 50%. That means if your vet bill is $2,000, a 70% plan covers $1,400. A 50% plan covers $1,000. The difference is $400 out of your pocket-and that’s just one visit.

Waiting Until Your Dog Is Sick to Buy Insurance

Insurance isn’t meant to cover what’s already broken. It’s meant to protect you from future accidents and illnesses. If your dog has a cough, a rash, or a limp, most companies will either deny coverage for that issue or charge you extra. Some even refuse to insure dogs over age 7 or 8.

Buy coverage while your dog is young and healthy. The earlier you enroll, the lower your premiums, and the more conditions you’ll be covered for. A 2024 study by the American Veterinary Medical Association showed that dogs enrolled before age one had 40% fewer claim denials than those enrolled after age three.

Not Understanding How Reimbursement Works

Most dog insurance doesn’t pay the vet directly. You pay upfront, then submit a claim and get reimbursed. That means you need to have cash on hand when your dog needs emergency care. If you’re counting on insurance to cover the bill at the time of service, you’ll be stuck.

Some companies take 10-14 days to process claims. Others take 30. One Portland owner had to pay $2,800 for her dog’s pancreatitis treatment and waited six weeks for reimbursement. She had to borrow money because her savings were low. She didn’t realize the delay was normal.

Always ask: “How long does reimbursement take?” and “Do I need to pay the full bill upfront?” Keep a small emergency fund-even $500-just in case.

Choosing a Plan That Doesn’t Cover Accidents

Many people think they only need coverage for illnesses. But accidents happen more often. A dog runs out the door and gets hit by a car. A puppy swallows a toy. A curious pup eats something toxic. These aren’t rare. In fact, accident claims make up 60% of all dog insurance claims.

Some basic plans only cover illness. If your dog gets into trouble, you’re on your own. Always choose a plan that includes both accident and illness coverage. That’s the minimum you need. Some plans even add alternative therapies like acupuncture or physical rehab-worth considering if your dog has chronic issues.

Failing to Compare Deductibles

A $500 deductible sounds better than a $1,000 one. But here’s the catch: lower deductibles mean higher monthly premiums. If your dog rarely gets sick, you might pay more over time than you save.

For example: A plan with a $500 deductible costs $45/month. A plan with a $1,000 deductible costs $28/month. If your dog has one vet visit a year costing $1,200:

- $500 deductible plan: You pay $500, insurer pays $700. Total annual cost: $540 ($540 = $540 in premiums + $500 out-of-pocket - $700 reimbursement = net $340 paid)

- $1,000 deductible plan: You pay $1,000, insurer pays $200. Total annual cost: $336 ($336 = $336 in premiums + $1,000 out-of-pocket - $200 reimbursement = net $1,136 paid)

Wait-that math doesn’t add up? Let me fix it: The total out-of-pocket cost for the $500 deductible plan is $540 (premiums) + $500 (your share) - $700 (reimbursement) = $340. For the $1,000 plan: $336 (premiums) + $1,000 (your share) - $200 (reimbursement) = $1,136. So the $500 deductible plan saves you $796 that year.

But if your dog has no vet visits, you just paid $540 extra in premiums. So match your deductible to your dog’s risk. Young, active dogs? Go low. Older, calm dogs? Higher deductible saves money.

Not Updating Your Policy When Your Dog’s Needs Change

Your 1-year-old pup is healthy. You pick a basic plan. Now he’s 6, and he’s developed arthritis. You want to upgrade. But you can’t. Most insurers won’t let you change coverage mid-policy. You’ll have to switch companies-and they’ll likely exclude the arthritis as pre-existing.

Review your plan every year. If your dog gains weight, becomes less active, or starts showing signs of aging, your coverage might not be enough. Talk to your insurer before your renewal date. Ask: “Can I increase my annual limit or add wellness coverage?” If they say no, start shopping early.

Ignoring Wellness Add-Ons

Most policies don’t cover vaccines, heartworm meds, or annual checkups. But those add up. A routine vet visit costs $80-$150. Flea and tick prevention? $100-$200 a year. Dental cleaning? $500.

Some insurers offer optional wellness plans for $10-$20 extra per month. They reimburse you for these routine costs. If you’re already paying $30-$50 a month for accident/illness coverage, adding $15 for wellness can save you $400-$600 a year. It’s not insurance-it’s a health savings account with a side of convenience.

One Oregon owner switched to a plan with wellness coverage and saved $520 last year on vaccines, flea meds, and a dental cleaning. She didn’t even notice she was paying more monthly.

Not Keeping Good Records

When you submit a claim, you need itemized receipts, vet notes, and sometimes lab results. Many people lose them. Or they don’t ask for them. I’ve seen claims denied because the owner couldn’t prove the diagnosis.

Always ask your vet for a copy of the invoice and diagnosis code. Save digital copies. Use a folder on your phone. Some insurers let you upload claims through their app. Don’t wait until the last minute. A claim denied because you “couldn’t find the receipt” is a claim you could’ve avoided.

Assuming All Plans Are the Same

There are over 30 dog insurance providers in the U.S. Each has different rules, networks, and payout structures. Some work with any vet. Others require you to use a specific network. Some pay based on the vet’s usual fee. Others use a benefit schedule that caps what they’ll pay for each procedure.

For example: A hip replacement might cost $4,500. One insurer pays 80% of the vet’s usual fee-$4,500. Another pays 80% of their own schedule-$2,800. That’s $1,700 you pay out of pocket.

Don’t just pick the cheapest. Compare how much each plan actually pays for common procedures. Ask for a sample claim scenario: “How much would you pay for a broken leg or a gastrointestinal foreign body?” The answers will surprise you.

Is dog insurance worth it if my dog is healthy?

Yes. Healthy dogs still get into accidents-eating something toxic, getting hit by a car, or swallowing a toy. Emergency care can cost $3,000-$5,000. Paying $20-$50 a month is cheaper than risking a big bill. Plus, enrolling while healthy means no exclusions for future conditions.

Can I get insurance for an older dog?

Yes, but coverage is limited. Most insurers set age limits between 7 and 10 years. Pre-existing conditions are excluded, and premiums rise sharply. Still, even partial coverage for accidents is better than nothing. Some companies specialize in senior dogs-shop around.

Do all vets accept dog insurance?

Yes, but not all insurers work the same way. Most plans let you visit any licensed vet in the U.S. You pay upfront, then get reimbursed. Some plans have preferred networks, but they’re rare. Always confirm the insurer doesn’t restrict your choice of vet.

How long does it take to get reimbursed?

Typically 7-30 days, depending on the company. Some process claims in 48 hours via app. Others take two weeks. Always ask about processing time before signing up. If you’re on a tight budget, choose a company with fast reimbursement.

What’s the best time to buy dog insurance?

The best time is when your dog is young and healthy-ideally under one year old. Premiums are lower, and you avoid exclusions for future conditions. Waiting until your dog shows symptoms means you’ll pay more and get less coverage.

Buying dog insurance isn’t about spending money-it’s about avoiding a financial disaster. The biggest mistake? Assuming you know what’s covered. You don’t. Read the fine print. Compare the real numbers. Ask hard questions. Your dog’s health-and your wallet-will thank you.